Converting 07 bitcoins to dollars involves considering factors like market demand, utility, and regulation impact. Choose reputable exchanges, stay secure with two-factor authentication, and never share private keys. IRS treats bitcoins as property for tax purposes, so keep detailed records. Forecast trends using technical analysis and historical data. Understanding Bitcoin's value drivers, using secure platforms, following tax rules, and forecasting trends can help you navigate the cryptocurrency market effectively.

Key Takeaways

- Bitcoin value fluctuates based on demand and supply dynamics.

- Limited supply and high demand can increase Bitcoin price.

- Consider exchange platforms with low fees and high security.

- Tax implications for selling bitcoins may include capital gains.

- Forecast Bitcoin-to-dollar trends using technical analysis and historical data.

Factors Influencing Bitcoin Value

One key factor that influences the value of Bitcoin is market demand and supply dynamics. Fundamentally, the price of Bitcoin is determined by how much people are willing to buy it for and how much sellers are willing to sell it for. When there's a high demand for Bitcoin but a limited supply available for purchase, the price tends to increase.

Conversely, if there's a high supply of Bitcoin in the market but a low demand from buyers, the price may decrease.

Another factor that affects Bitcoin's value is its utility and perceived value. As more businesses and individuals start accepting Bitcoin as a form of payment, its utility increases, which can drive up demand and subsequently its price.

Additionally, external factors such as regulatory developments, market sentiment, and macroeconomic trends can also impact the value of Bitcoin.

Understanding these factors can help you make more informed decisions when buying, selling, or investing in Bitcoin. Keep an eye on market dynamics, utility, and external influences to navigate the volatile world of Bitcoin value.

Popular Exchange Platforms

Market demand and supply dynamics play a significant role in selecting popular exchange platforms for trading Bitcoin to dollars. When searching for a platform, take into account factors like fees, security measures, user interface, and trading volume.

Coinbase is a well-known exchange that offers a user-friendly interface and high liquidity, making it a preferred choice for many traders.

Another popular option is Binance, which provides a wide range of cryptocurrencies for trading against the dollar.

Kraken is renowned for its security features and diverse trading pairs, attracting both beginners and experienced traders.

For those looking for advanced trading options, Bitfinex offers features like margin trading and lending.

Gemini is another reputable platform known for its regulatory compliance and strong security protocols.

Researching and comparing different platforms is crucial to find one that aligns with your trading preferences and requirements. Remember to take into consideration factors like fees, security, and available trading pairs to make an informed decision when selecting an exchange platform for your Bitcoin to dollar transactions.

Tips for Secure Transactions

Protect your transactions remain secure by implementing these recommended tips.

First and foremost, always use secure and reputable exchange platforms when converting your bitcoins to dollars. Look for platforms with robust security measures such as two-factor authentication and encryption protocols to safeguard your transactions.

Secondly, never share your private keys or passwords with anyone. These are the keys to your digital wallet, and keeping them confidential is vital for maintaining the security of your funds. Be cautious of phishing attempts or fraudulent websites that may try to trick you into revealing this sensitive information.

Additionally, consider using a hardware wallet for storing your bitcoins securely. Hardware wallets are physical devices that store your private keys offline, making them less vulnerable to hacking attempts compared to online wallets.

Lastly, regularly update your software and enable security features like automatic updates and firewall protection on your devices. By staying proactive and following these tips, you can help ensure that your bitcoin to dollar transactions are conducted safely and securely.

Tax Implications and Regulations

When converting bitcoins to dollars, it's important to be aware of the tax implications and regulations that may apply to your transactions. The IRS considers bitcoins as property rather than currency, meaning that selling bitcoins for dollars can result in capital gains or losses. If you held the bitcoins for more than a year before selling, the gains may be taxed at a lower rate compared to short-term holdings.

Keep detailed records of your transactions, including the date of acquisition, purchase price, date of sale, and selling price, to accurately report your capital gains or losses when filing your taxes.

Additionally, depending on your country of residence, there may be specific regulations governing the conversion of bitcoins to fiat currency. Some countries require individuals to report cryptocurrency transactions above a certain threshold or may have restrictions on using cryptocurrencies for payments. Failure to adhere to these regulations could lead to penalties or legal consequences.

It's advisable to consult with a tax professional or legal advisor to make sure that you're compliant with tax laws and regulations when converting bitcoins to dollars.

Forecasting Bitcoin-to-Dollar Trends

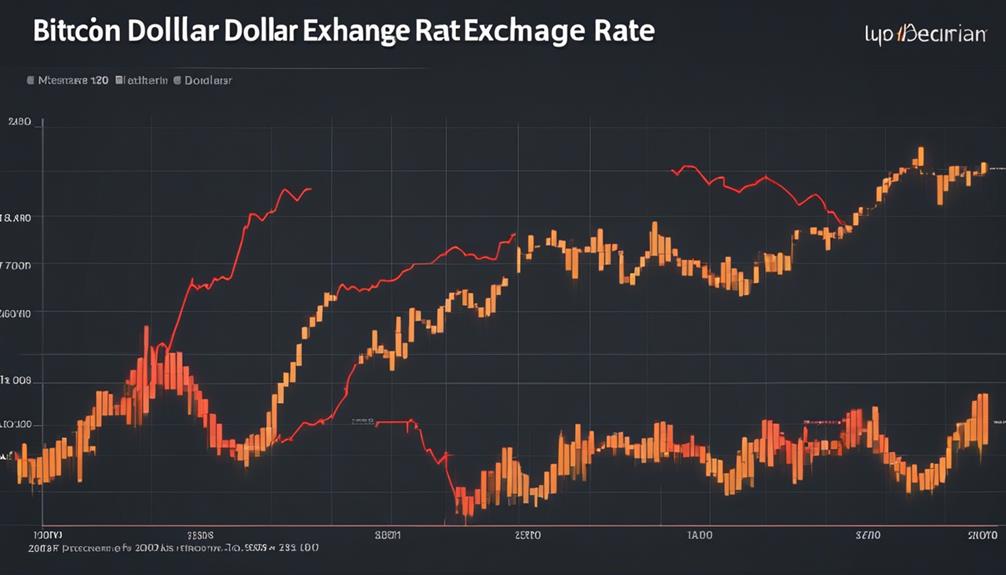

Predicting shifts in the Bitcoin-to-dollar exchange rate can be difficult but essential for informed decision-making in the cryptocurrency market. To forecast Bitcoin-to-dollar trends, you should consider both technical analysis and fundamental factors.

Technical analysis involves studying historical price charts, identifying patterns, and using indicators to predict potential price movements. Keep an eye on key levels of support and resistance, as breakouts from these levels can signal trend reversals.

Additionally, pay attention to market sentiment, news events, and regulatory developments that can influence Bitcoin's price. Factors like institutional adoption, macroeconomic trends, and geopolitical events can all impact the cryptocurrency market. Stay updated on the latest news and developments in the crypto space to anticipate potential price fluctuations.

Moreover, consider using tools like moving averages, Relative Strength Index (RSI), and Fibonacci retracement levels to analyze price trends and predict possible future movements.

Remember that while forecasting Bitcoin-to-dollar trends can be challenging, staying informed and utilizing various analytical tools can help you make more informed decisions in the volatile cryptocurrency market.

Conclusion

Overall, converting bitcoins to dollars can be influenced by various factors such as market demand, exchange platforms, security measures, and tax regulations.

By staying informed and utilizing reputable exchange platforms, you can guarantee a secure and efficient transaction process.

Keep in mind the potential tax implications and stay updated on the latest trends to make informed decisions when converting bitcoins to dollars.