Exploring the World of Crypto Pumps: Where to Dive In, Unveiling Risks, and Legal Consequences

In the ever-evolving and intriguing realm of cryptocurrencies, the allure of quick gains through a crypto pump is undeniable. As a crypto expert, I recognize the magnetism of participating in such events. However, caution and awareness are paramount when venturing into these turbulent waters. In this article, we will navigate the avenues of crypto pumps, unveil the associated risks, and shed light on the potential legal ramifications of engaging in such activities.

Navigating the Crypto Pump and Dump Universe on Telegram

One of the most common gateways into the world of crypto pumps is through Telegram groups that furnish pump and dump signals. These groups operate as meeting grounds for participants to synergize their efforts in inflating the value of a specific cryptocurrency before orchestrating a strategic sell-off for profit.

Telegram Groups: Telegram, a favored platform among crypto enthusiasts, hosts a plethora of pump and dump groups. Joining these groups can be as straightforward as finding the right one and requesting membership. Notable groups such as Mega Pump Group, Big Pump Signal, and Big Pump Group have garnered attention for their orchestrated endeavors in pumping cryptocurrency values.

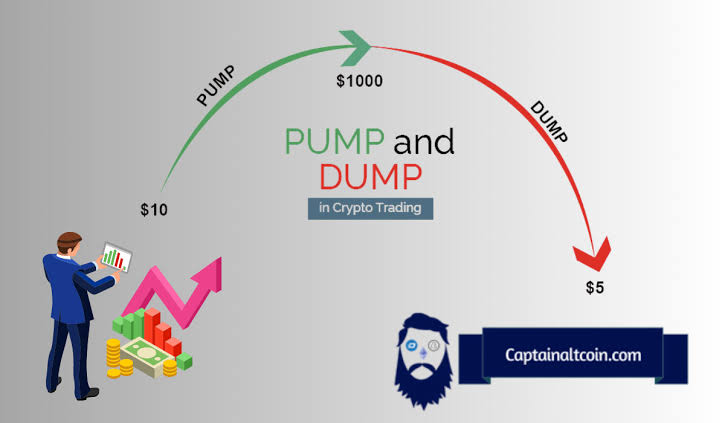

Mechanics at Play: Within these Telegram groups, the chosen cryptocurrency becomes the focal point. Participants collectively invest in it, generating artificial demand that propels the price skyward. Once the price reaches a desirable zenith, group organizers trigger the sell-off, and participants endeavor to reap profits from the ensuing price surge.

Immersing Yourself in Crypto Pumps through Discord

Crypto Discord servers offer another avenue to plunge into the world of crypto pumps. Communities like AXION Crypto-Community, Cryptohub, and Elite Crypto Signals provide members with valuable pump signals and trading insights.

Discord Servers: Discord, renowned for its dynamic crypto communities, is home to servers dedicated to cryptocurrencies. Joining these servers might entail an invitation or joining via a public link, depending on their setup.

Community and Signals: Beyond serving as platforms for pump and dump endeavors, these Discord servers foster a sense of community. They offer channels and sections for discussing trading strategies, sharing knowledge, and staying informed about the latest developments in the crypto market.

Harnessing the Power of Crypto Pump Apps

For those seeking a comprehensive solution, crypto pump apps present an attractive option. Crypto Pump Finder, for instance, is a mobile application tailored to crypto traders. It offers features such as crypto portfolio tracking, market analysis, real-time signals, alerts, and more.

Crypto Pump Apps: The cryptocurrency landscape has witnessed the emergence of mobile applications designed to empower crypto enthusiasts. Apps like Crypto Pump Finder provide an all-in-one solution. Users can efficiently monitor their crypto portfolios, access market analysis, and receive real-time signals for potential investment opportunities.

Feature-Rich Platforms: These apps boast user-friendly interfaces that enhance the trading experience. They facilitate access to comprehensive information about various cryptocurrencies, enable real-time alerts, and streamline participation in pump and dump activities through the app.

Navigating the Murky Waters: Cautionary Insights on Pump and Dump Schemes

Participating in pump and dump schemes necessitates a judicious approach. These activities are not merely ethically questionable but often veer into legally murky terrain. Scammers frequently leverage chat groups on platforms like Discord and Telegram, enticing investors to buy into obscure coins with promises of astronomical returns. These schemes can culminate in substantial financial losses, underscoring the need for a vigilant awareness of their existence.

Illuminating the Risks: The risks entailed in pump and dump schemes are multifaceted. Chief among them is the looming specter of financial loss, often of substantial magnitude. The artificial inflation of cryptocurrency values within these groups creates a deceptive sense of demand, leading to significant financial setbacks when the inevitable price correction occurs.

Unmasking Market Manipulation: The term “market manipulation” often finds association with pump and dump schemes. It refers to the orchestrated inflation of a security’s price or the deliberate alteration of market behavior to serve personal gain. Market manipulation constitutes a grave offense and can result in stringent legal repercussions.

The Menace of Scams: Many pump and dump groups operate as elaborate scams, adept at exploiting unsuspecting investors. Scammers adroitly employ chat groups on platforms like Discord and Telegram to promote obscure cryptocurrencies, persuading others to partake in their fraudulent designs. The ramifications of falling prey to these scams are dire, resulting in substantial financial adversity.

Navigating Regulatory Uncertainty: Cryptocurrencies exist in a sphere with limited governmental oversight, rendering them susceptible to market manipulation. While pump and dump crypto schemes may traverse the realms of moral and legal ambiguity, they may not overtly transgress existing laws in certain jurisdictions. Staying vigilant and informed about the potential risks attached to these schemes is paramount.

The importance of conducting exhaustive research, comprehending the risks inherent in such activities, and adopting a circumspect approach before embarking on any investment journey cannot be overstated.

Unpacking Risks Inherent in Joining a Crypto Pump-and-Dump Group

As a crypto authority, I feel compelled to illuminate the inherent risks in joining a crypto pump-and-dump group. These risks possess the potential to precipitate profound financial losses. Let us explore the key risks:

Risk of Monetary Loss: The primary peril of joining a crypto

pump-and-dump group is the conceivable loss of funds, oftentimes in substantial amounts. These groups orchestrate artificial inflation of cryptocurrency prices, instilling a deceptive perception of demand. Consequently, investors who purchase at inflated prices find themselves confronted with notable financial setbacks when prices inevitably retract.

Moral and Legal Quagmire: Pump-and-dump crypto groups traverse treacherous moral and legal terrain. In certain jurisdictions, participation in such groups is classified as market manipulation, breaching securities regulations. Regulatory bodies such as the United States’ Securities and Exchange Commission (SEC) have resorted to punitive measures against individuals and groups embroiled in pump-and-dump schemes.

Guarding Against Schemes: Unscrupulous individuals habitually prey on newcomers in the cryptocurrency domain. They market little-known cryptocurrencies, stoking enthusiasm, and enticing investors to partake, only to abandon ship when prices attain their zenith. Shielding oneself from these schemes mandates an unwavering commitment to staying informed, executing comprehensive research, and seeking guidance from reputable sources.

Legal Repercussions: The Weight of Participating in a Pump-and-Dump Group

Participating in a pump-and-dump group unfurls the potential for severe legal consequences. Individuals involved in these activities, encompassing both organizers and participants knowingly engaged in market manipulation, could find themselves subject to penalties grounded in securities laws.

Legal Ramifications: These legal repercussions span an array of penalties, encompassing fines, disgorgement of profits, and, in more egregious cases, imprisonment. The inherently fraudulent and misleading nature of pump-and-dump activities render them patently illegal. Regulatory bodies, such as the SEC in the United States, exhibit resolute resolve in pursuing individuals and groups implicated in these activities. The intent is to deter individuals from partaking in market manipulation.

Catalysts for Compliance and Deterrence: Legal consequences assume the role of catalysts for ensuring compliance and deterring fraudulent practices in the crypto domain. Regulatory authorities meticulously monitor these activities and adopt a stringent stance against wrongdoers.

Understanding and adhering to the laws and regulations pertinent to your jurisdiction is of paramount importance before embarking on any involvement with a pump-and-dump group.

Seeking the Beacon of Legitimacy Amidst the Risks

Identifying legitimate crypto pump-and-dump groups can be an onerous task, especially in light of the associated risks. However, if you still harbor a desire to explore these groups, several methodologies can be employed to identify potentially reliable options:

Harnessing the Power of Online Research: Online platforms serve as a reservoir of information regarding crypto pump-and-dump groups. They offer insights into the groups’ credibility and operational mechanisms. Websites like Pump-Groups.com and Traders Union furnish invaluable information about the premier pump groups, encompassing vital data such as membership numbers and the exchanges they operate on.

Joining the Ranks of Telegram Groups: Telegram retains its eminence as a preferred platform for crypto pump-and-dump groups. By conducting searches on Telegram or leveraging platforms like Pump-Groups.com, you can unearth suitable groups. Nonetheless, an undercurrent of caution should pervade your actions. Engage in comprehensive research and confirm the legitimacy of the groups before embarking on your journey.

Exercising Due Caution: The exercise of caution is non-negotiable when navigating the treacherous waters of crypto pump-and-dump groups. An unfortunate truth is that a multitude of these groups function as elaborate scams, adept at ensnaring unsuspecting investors. Engaging in rigorous personal research, critically assessing the claims proffered by these groups, and seeking counsel from trustworthy sources are prerequisites before venturing into any investment terrain.

The Significance of Establishment Dates: The establishment date of a group serves as a beacon for assessing its legitimacy. Newly formed groups often lack a track record or have yet to accrue credibility. It is advisable to veer toward groups with a substantial operational history, for such groups are more likely to exhibit reliability.

The indomitable importance of recognizing the potential legal consequences and significant financial risks attendant to participation in a pump-and-dump group cannot be overstated. Therefore, it is imperative to acquaint oneself with the legal parameters of your jurisdiction and make discerning, well-informed decisions before setting foot on this intriguing yet precarious path.

Conclusion: Navigating the Crypto Pumps – A Balancing Act of Opportunity and Caution

In the exciting and often bewildering landscape of cryptocurrencies, the allure of joining a crypto pump cannot be denied. The promise of quick financial gains in a market known for its volatility is undoubtedly tempting. However, as we’ve delved deep into the subject, it becomes abundantly clear that this journey is not one to be undertaken lightly. The path to participating in a crypto pump is riddled with opportunities, risks, and legal consequences, and a careful balancing act is required to navigate it successfully.

Crypto pumps come in various forms, with Telegram groups and Discord servers being popular platforms where these orchestrated price surges take place. These groups bring together individuals with a common goal – inflating the value of a specific cryptocurrency and then selling it at a profit. While the mechanics are relatively simple, the implications are profound. Joining a Telegram group like Mega Pump Group or a Discord server like AXION Crypto-Community can grant you access to a world of potential financial gains, but the risks loom large.

The risks associated with crypto pumps are multifaceted and cannot be overstated. The most immediate and tangible risk is the possibility of losing money. These schemes artificially inflate cryptocurrency values, creating a false sense of demand that eventually leads to price crashes, leaving those who bought at inflated prices with substantial financial losses.

Furthermore, participating in pump and dump groups isn’t merely ethically questionable; it often crosses into the territory of illegality. In many jurisdictions, it’s considered market manipulation, a serious violation of securities laws. Regulatory bodies like the United States’ Securities and Exchange Commission (SEC) have not hesitated to take action against those involved in these schemes.

Scams are another menace that plagues the crypto pump landscape. Unscrupulous individuals leverage chat groups on platforms like Discord and Telegram to promote obscure cryptocurrencies and entice others to join, only to vanish once the price peaks. Falling victim to such scams can result in severe financial consequences, making it imperative to stay informed, conduct thorough research, and seek advice from trusted sources.

The lack of robust government regulation in the cryptocurrency space further exacerbates the risks. While pump and dump crypto schemes may be morally and legally dubious, they might not explicitly violate existing laws in some jurisdictions. This regulatory uncertainty amplifies the need for caution and awareness.

In conclusion, while the allure of crypto pumps is undeniable, they are a double-edged sword. The potential for quick financial gains is balanced by significant risks and the specter of legal consequences. As a responsible crypto enthusiast, it’s essential to conduct thorough research, understand the laws and regulations in your jurisdiction, and exercise caution before participating in any pump and dump activities.

Remember that the crypto landscape is vast, and there are legitimate ways to invest and trade in cryptocurrencies without resorting to high-risk pump and dump schemes. In your crypto journey, seek the path of prudence and well-informed decision-making to truly thrive in this exciting and dynamic realm.